The Single Strategy To Use For Certified Public Accountant Association

Table of ContentsSome Ideas on Certified Public Accountant Association You Should KnowUnknown Facts About Certified Public Accountant AssociationSome Ideas on Certified Public Accountant Association You Need To KnowThe 5-Second Trick For Certified Public Accountant AssociationMore About Certified Public Accountant Association

State Requirements and Codes of Principles The certificate is not the only requirement to be a CPA. Capella University supplies an as well as a, permitting you to customize your program to your state's CPA demands.Students likewise need to recognize as well as follow their particular state licensing requirements.

A Certified Public Accountant (State-licensed Accountant) is an accountancy expert licensed and credentialed by a state or region to supply accounting solutions, consisting of tax obligation preparation, to the public. A Certified Public Accountant (certified public accounting professional) is an accountancy professional certified as well as credentialed by a state or territory to provide bookkeeping services, consisting of tax obligation prep work, to the public.

4 million accountants in 2016, but only concerning half of those (664,532) are CPAs who are signed up with National Organization of State Boards of Accountancy. What does a CPA do? An important task of many Certified public accountants is to maintain or check monetary records to make sure that that the info they represent is accurate and also complies with appropriate legislations and also regulations.

See This Report on Certified Public Accountant Association

The accountant can not supply attestation services. You are required to have a Certified Public Accountant permit to provide attestation services. No Permit is needed to be an accountant. The license is called for to be a CPA.The accounting professional has no standing with the Internal Revenue Service (Internal Profits Solutions)Certified public accountants can stand for a taxpayer before the Internal Revenue Service (Internal Earnings Services)Accountants can not authorize income tax return or stand for customers during tax obligation Audits before IRS.CPAs can sign income tax return as well as likewise stand for customers during tax audits prior to the IRS.No specific Governing Body.

Local business usually may not require an audited or reviewed economic declaration, yet public companies are called for to publish audited statements. When people or organizations make this choice of picking in between a Certified Public Accountant and an accountant, this is one of the crucial factors to consider they think about. Advised Articles This has actually been an overview to the leading differences in between Bookkeeping vs.

Getting The Certified Public Accountant Association To Work

Here we additionally review the Bookkeeping and Certified Public Accountant essential distinctions in addition to Instance, Infographics, History, as well as contrast table. You might likewise look at the complying with posts.

Due to the present financial situations in America, companies are placing a higher concern on their bookkeeping methods and are looking for more certified specialist accountants to bring on their financial groups. With the raised demand in accountancy, the field is anticipated to experience fast development at the price of 16 percent from 2010 to 2020, which is quicker helpful site than the average of other careers.

The following is a guide to the profession you can try here course of public accountant, among the most preferred distinctive functions in audit. Work Summary of Public Accountants Accountant are responsible for preparing and also assessing financial records to guarantee that all funds have actually been represented precisely and are certified with laws.

Facts About Certified Public Accountant Association Uncovered

Along with increased income potential, the Certified Public Accountant credential can raise your overall earnings as well as give a number of other advantages that will certainly strengthen your accountancy job. The economic incentives of the Certified Public Accountant credential begin terrific as well as improve gradually. Several companies incentivize workers to pass the Certified Public Accountant Test by providing a completion bonus offer of a number of thousand bucks.

What Is a CPA?, you'll need a basic interpretation of a CPA.

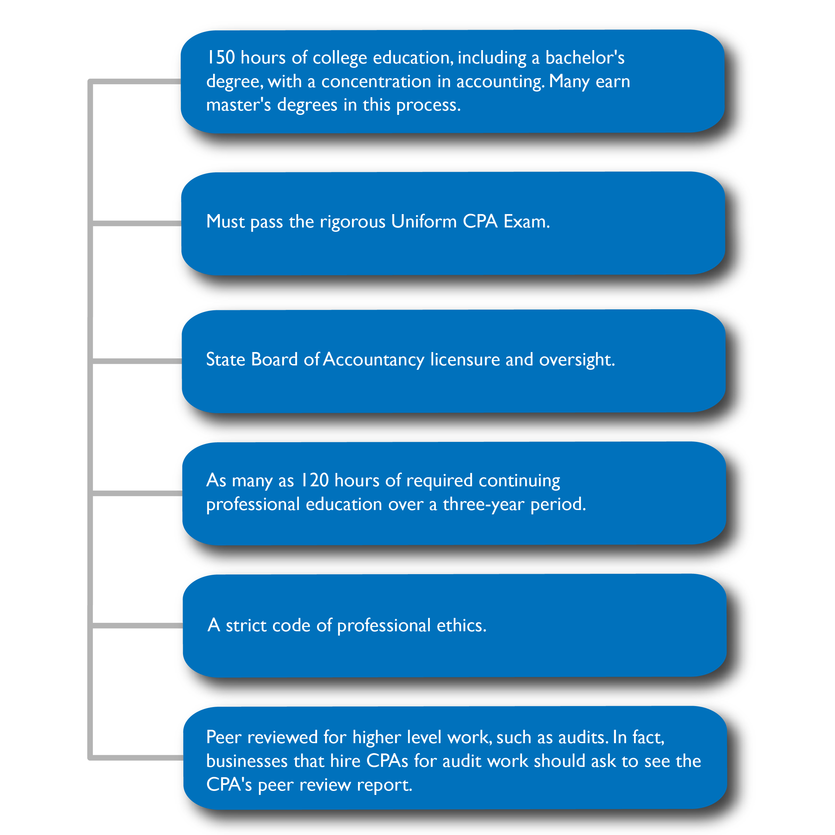

The boards of accountancy in each of the 55 UNITED STATE territories grant the CPA to accounting professionals after these accountants fulfill a collection of demands certain to their state board. The state boards hold CPA prospects to the greatest of requirements due to the fact that Certified public accountants are accounting experts handed over to safeguard the general public rate of interest.

What Is the Difference Between an Accounting Professional as well as a Certified Public Accountant? Comprehending the distinction in between an accounting professional and a CPA allows you to see simply how distinguished the Certified Public Accountant certification is. certified public accountant association. Essentially, a CPA differs from an accounting professional in 2 methods:: Only Certified public accountants have the lawful authority to audit public business.

Fascination About Certified Public Accountant Association

CPAs can stand for clients in matters associated to audits or collections. A Certified Public Accountant can also authorize a customer's tax return as a paid preparer. What Does a Certified Public Accountant Do?

The SEC calls for that all public business have a CPA company audit their economic declarations prior to the details is provided to shareholders as well as the public. So, if read what he said you select to concentrate on auditing with your CPA license, you can anticipate to be in demand. As a 2nd piece of the audit, CPAs are frequently called on to clarify their findings to a business's execs and/or board.